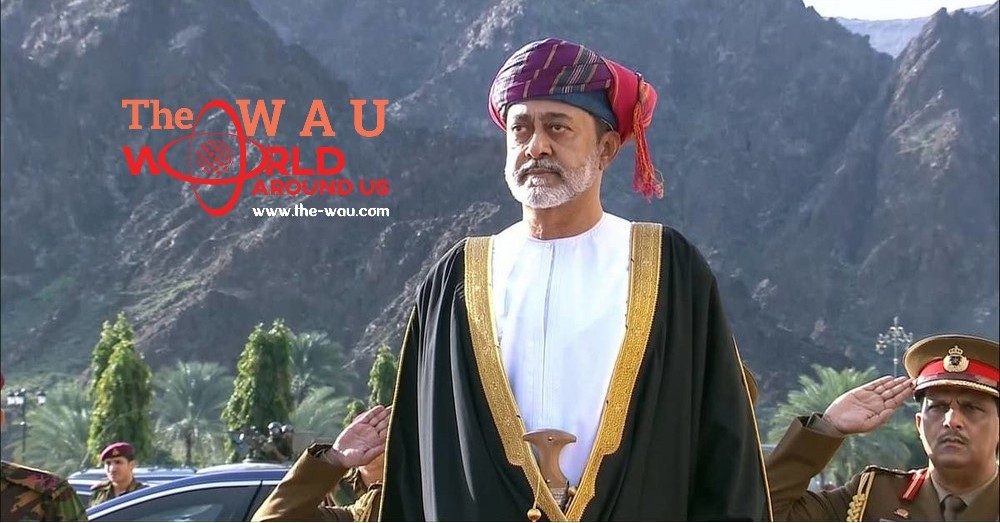

All you need to know about Oman & New Prince!

The transition of strength in Oman from the deceased Sultan Qaboos to his cousin and the country’s new ruler, Sultan Haitham bin Tariq, has been clean and quick, but the new sultan will soon find that he has a assignment in shoring up the country’s financial position.

Above all, the fiscal and debt profile of the u . s . requires cautious management. Fiscal self-discipline was once rare for Oman even at some stage in the oil rate spike of the 2000s. Although oil expenditures solely collapsed in 2014, Oman has been registering a fiscal deficit for the reason that 2010, accomplishing a 20.6 per cent excessive in 2016. As long as fiscal deficits stay elevated, so will Oman’s need to finance these deficits, predominately via borrowing in the nearby and worldwide market.

A worry for Oman’s Debt-to-GDP ratio has been rising , from only 4.9 per cent in 2014 to an estimated 59.8 per cent by 2019. Whereas By 2024, the IMF is forecasting the ratio to reach nearly 77 per cent.

Investors are willing to lend to Oman, but the sultanate is paying for it in terms of higher spreads due to the underlying hazard markets are placing on the rising debt profile of the country. For instance, Oman has a higher sovereign debt ranking than Bahrain but markets discover it to be of higher risk, making it costlier to borrow. Failure to address the fiscal and debt state of affairs also dangers creating strain on the country’s pegged currency.

If oil revenues remain low, Sultan Haitham will have to craft a daring method of diversification and private area growth. He is properly placed for this: Sultan Haitham headed Oman’s Vision 2040, which set out the country’s future improvement plans and aspirations, the first Gulf united states of america to embark on such an assessment. However, like all imaginative and prescient archives in the Gulf, Oman’s challenge will be implementation.

In the age of climate change, renewable energy is a serious economic opportunity, which Oman has to hold pursuing. If cheap electrical energy is generated it could also be exported to different Gulf states and to south Asia. In Oman, the share of renewables in complete electrical energy capability was round 0.5 per cent in 2018; the ambition is to reach 10 per cent by using 2025.

However, in order to attain this target, Oman would have to take extra measures such as improving its regulatory framework, introducing a obvious and gradual strength market pricing policy and integrating all stakeholders, along with the non-public sector, into a wider country wide strategy.

Mining may want to provide any other economic probability for Oman’s diversification efforts, with help from a greater robust mining regulation handed remaining year. The united states has large deposits of metals and industrial minerals and its mountains ought to have gold, palladium, zinc, rare earths and manganese.

Oman’s strategic region connecting the Gulf and Indian Ocean with east Africa and the Red Sea may want to also boost the country’s economy. The Duqm exceptional financial zone, which is among the greatest in the world, ought to turn out to be the business thread between Oman, south Asia and China’s ‘Belt and Road Initiative.’

Oman has taken necessary steps to make its financial system greater competitive and conducive to foreign direct investment. Incentives encompass a five-year renewable tax holiday, backed plant amenities and utilities, and custom duties relief on gear and uncooked materials for the first 10 years of a firm’s operation in Oman.

A personal region financial mannequin that embraces small- and medium-sized businesses as properly as greater competition and entrepreneurship would help make bigger opportunities in Oman. Like all different Gulf economies, future employment in Oman will have to be pushed be the personal sector, as there is little space left to grow the public sector.

Privatization wants to continue. Last year’s successful sale of 49 per cent of the electrical energy transmission corporation to China’s State Grid is a very effective step. The electricity distribution employer as nicely as Oman Oil are subsequent in line for some structure of partial privatization.

The next decade will require Oman to be even greater adept in its competitiveness as the area itself tries to discover its new bearings. Take tourism for instance; Oman hopes to double its contribution to GDP from around 3 per cent nowadays to 6 per cent with the aid of 2040 and the industry is expected to generate half of a million jobs by using then. Over the next 20 years, Oman will most likely be dealing with stiff competition in this vicinity no longer only through the UAE but by using Saudi Arabia as well.

The new sultan has an chance to embark on deeper economic reforms that may want to deliver greater growth, employment possibilities and a sustainable future. But he has a big task.

Share This Post