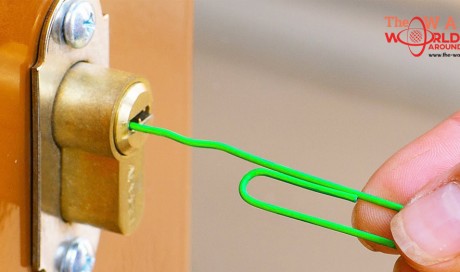

A stylus is not attached

All payment terminals have a stylus attached to them that clients use to enter their signature after their card has been scanned. A skimmer inside an iSC250 doesn’t allow the stylus to be attached.

How to protect your money

- The most effective way to protect yourself from fraud is by having a separate debit card that would only have the sum you need for a purchase at hand.

- Connect to the SMS banking service to promptly react to unexpected debits.

- Set limits and limit cash withdrawal amounts, and the criminals won’t be able to withdraw all your money at once.

- If you have lost your card and you think someone may have learned its details, immediately call your bank and block it.

- It’s also good to learn about card insurance capabilities and terms with your bank. Some credit organizations have special programs for protecting their clients from fraud and reimbursement of damages.

- When you pay with your card in a store, make sure that the employees do not take it away from you. If you pay in a restaurant, don’t let the waiter take away the card — they can skim it discreetly. Demand that all the operations be carried out in your presence.

- Read the receipts carefully after paying with your card. The field with the paid amount must not be empty.

Share This Post